The ProShares UltraPro Short S&P 500 ETF (SPXU) is a leveraged tool designed to amplify the inverse returns of the S&P 500 index. This means that for every 1% decrease in the S&P 500, SPXU targets to increase by 3%. While this possibility for amplified gains can be attractive for traders website seeking short-term exposure to market downswings, it's crucial to recognize the inherent challenges associated with leveraged ETFs.

Investors considering SPXU should carefully review its history, considering factors like volatility, correlation to the S&P 500, and possible impact on their overall financial plan. It's essential to remember that leveraged ETFs are not suitable for all participants and should only be used by those with a high capacity and a clear understanding of the associated nuances.

Unlocking S&P 500 Bear Market Potential with a 3x Leveraged Strategy

For investors targeting lucrative opportunities in a potential downward market, the SPXU ETF presents a compelling instrument. This triple-leveraged short ETF aims to profit from reductions in the S&P 500 index. By utilizing SPXU, investors can escalate their potential returns during periods of market downturns. However, it's crucial to recognize the inherent challenges associated with leveraged ETFs like SPXU.

- Leverage can multiply both profits and losses.

- Market Fluctuation in the S&P 500 index can have a considerable impact on SPXU's performance.

- Comprehensive research and risk management are crucial before participating in SPXU.

SPXU offers a effective tool for experienced investors aiming to profit from potential S&P 500 declines. Nevertheless, it's paramount to approach this investment with vigilance and a clear understanding of its inherent risks.

Taming the Bear Market Wave: How to Exploit SPXU for Lucrative Shorting

A bear market can be a daunting landscape for many investors, but it also presents a unique chance to profit. For those with a aggressive strategy, shorting the market through Exchange-Traded Funds (ETFs) like SPXU can be a potent tool. SPXU, which mirrors the inverse performance of the S&P 500 index, allows investors to gain when the market falls.

However, shorting is a risky endeavor that requires careful planning. Before diving in, investors must meticulously understand the dynamics of short selling and the potential consequences involved.

This article will analyze the aspects of using SPXU for shorting in a bear market, providing valuable tips to help you tackle this complex investment strategy.

SPXU ETF Analysis: Assessing Returns and Risks in a Volatile Market

The SPXU ETF, a popular leveraged instrument tracking the S&P 500 index inverse performance, presents both attractive returns potential and substantial risks, especially within a fluctuating market environment. Investors seeking to capitalize on falls in the S&P 500 may find SPXU {appealing|, but its high leverage amplifies both gains and losses, demanding a comprehensive understanding of market dynamics. Before considering an investment in SPXU, it's crucial to analyze its historical performance , understand the associated perils, and develop a well-informed investment approach.

A key factor in SPXU's results is its leverage, which magnifies both positive and negative market movements. {While this can lead to significant returns during bearish phases, it also exposes investors to substantial losses when the market moves against their position. It's crucial for investors to track market conditions closely and adjust their positions accordingly to mitigate potential negative impacts.

- {Furthermore,|Additionally|, it's important to note that SPXU is a short-term investment vehicle best suited for experienced traders with a high tolerance for risk.

- Long-term investors may find its volatility and leverage inappropriate for their goals.

In conclusion, the SPXU ETF can offer significant returns in a declining market but comes with inherent risks that require careful consideration. Investors must thoroughly evaluate its performance history, understand its leverage implications, and develop a well-defined investment strategy to potentially exploit market volatility while effectively managing risk.

Navigating the Volatility: A Practical Guide to Using SPXU for S&P 500 Shorting

The S&P 500 is a notoriously volatile index, known for its dramatic swings upwards. For savvy investors seeking to profit from market downturns, the Exchange-Traded Fund (ETF) SPXU presents a powerful tool. This ETF provides leveraged exposure to the inverse performance of the S&P 500, offering investors the potential for significant gains during periods of negative momentum. However, navigating its volatility requires a disciplined and strategic approach. Before diving into shorting with SPXU, it's crucial to thoroughly understand its mechanics, risks, and optimal trading strategies.

- Begin by grasping the concept of leverage. SPXU amplifies both profits and losses, meaning even small market movements can result in substantial gains. This requires careful position sizing and risk management to avoid excessive exposure.

- Execute thorough research on current market conditions and identify potential catalysts for an S&P 500 decline. Monitor economic indicators, news events, and sentiment analysis to gauge market trajectory.

- Utilize technical analysis tools, such as charting patterns and moving averages, to identify short points and potential support and resistance levels. Remember that SPXU's performance can diverge from the underlying S&P 500 index due to its leveraged nature.

Establish realistic profit targets and stop-loss orders to limit potential losses. Regularly review your positions and adjust your strategy as market conditions evolve. Remember, shorting is a challenging endeavor that demands patience, discipline, and continuous learning.

Understanding SPXU's Returns: Factors Affecting This 3x Leveraged Short ETF

SPXU, the ProShares UltraPro Inverse S&P 500 ETF, presents a unique investment vehicle. This 3x leveraged ETF aims to generate returns that are three times the inverse of the daily movements of the S&P 500 index. Mastering SPXU's performance requires analyzing a variety of factors, including fundamental market trends, investor sentiment, and the ETF's structure.

Market volatility can significantly impact SPXU's returns. During periods of steep market declines, SPXU tends to excel, as its leverage amplifies the profits. Conversely, during bullish markets, SPXU may suffer, as its daily inverse performance gets magnified.

Additionally, investor sentiment can shape SPXU's popularity. When investors are negative about the market outlook, they may flock to leveraged short ETFs like SPXU in an attempt to capitalize from potential declines. Conversely, during periods of bullishness, investor appetite for SPXU may diminish.

Rider Strong Then & Now!

Rider Strong Then & Now! Scott Baio Then & Now!

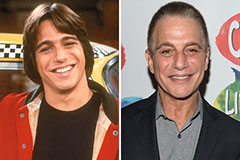

Scott Baio Then & Now! Tony Danza Then & Now!

Tony Danza Then & Now! Anthony Michael Hall Then & Now!

Anthony Michael Hall Then & Now! Ryan Phillippe Then & Now!

Ryan Phillippe Then & Now!